Importers and exporters normally require intermediaries such as banks or alternative financiers to guarantee payment and also the delivery of goods. Cash advances or trade credits on open accounts are usually used after the buyer and seller develop a trusted relationship. Therefore, trade finance structures are used to support these relationships.

Letter of Credit: Complete Guide

Relationships between buyers and sellers are based largely on trust. Regardless of whether you are a buyer, seller, or end user of a product or service, being certain about the intentions of the other parties, and having security that they will honour their part of the deal is critical when trading overseas. It’s often easier to have a relationship with your supplier if you’re trading domestically (within the same region), but what if your supplier is less well known, perhaps based overseas? Although around 80% of global trade occurs on open account terms (buy now, pay later), suppliers now often ask for full payment up front. For businesses, access to credit lines which allow not only provide some form of guarantee and peace of mind that your goods will be protected, but also the offer of flexible payment terms, can be achieved through a Letter of Credit.

A Letter of Credit (or LC) is a commonly used trade finance instrument used to ensure that the payment of goods and services will be fulfilled between a buyer and a seller. The rules of a Letter of Credit are issued and defined by the International Chamber of Commerce through their Uniform Customs & Practice for Documentary Credits (UCP 600), used by producers and traders worldwide. Both parties use an intermediary, namely a bank or financier, to issue a Letter of Credit and legally guarantee that the goods or services received will be paid for.

How do You Use a Letter of Credit?

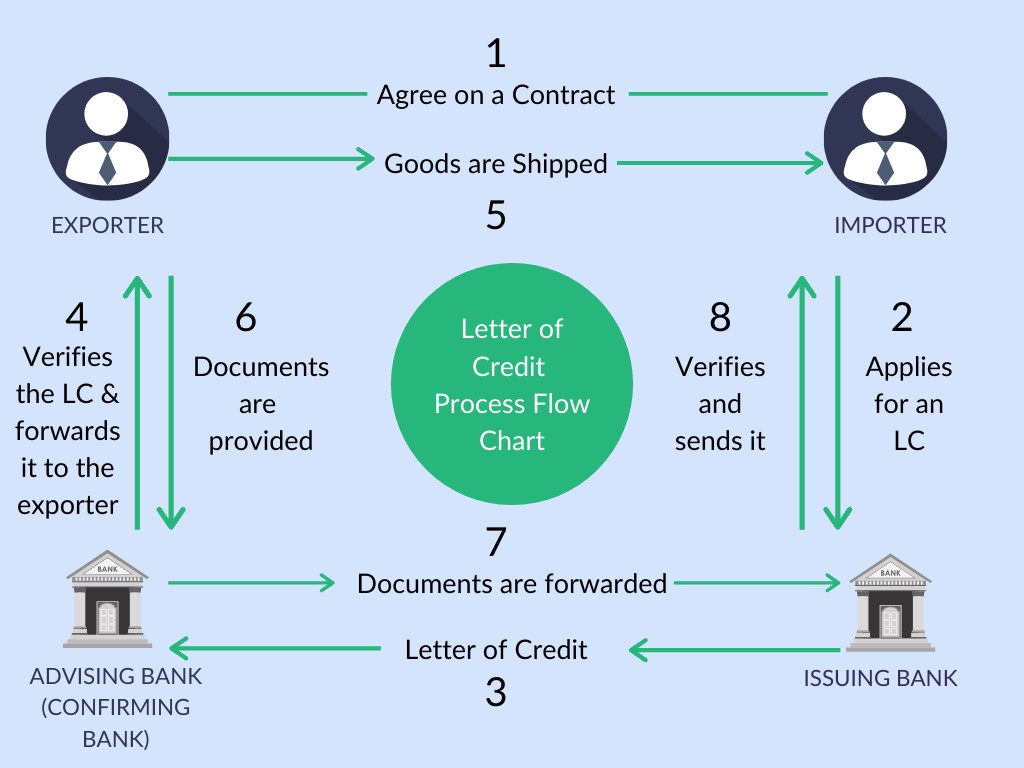

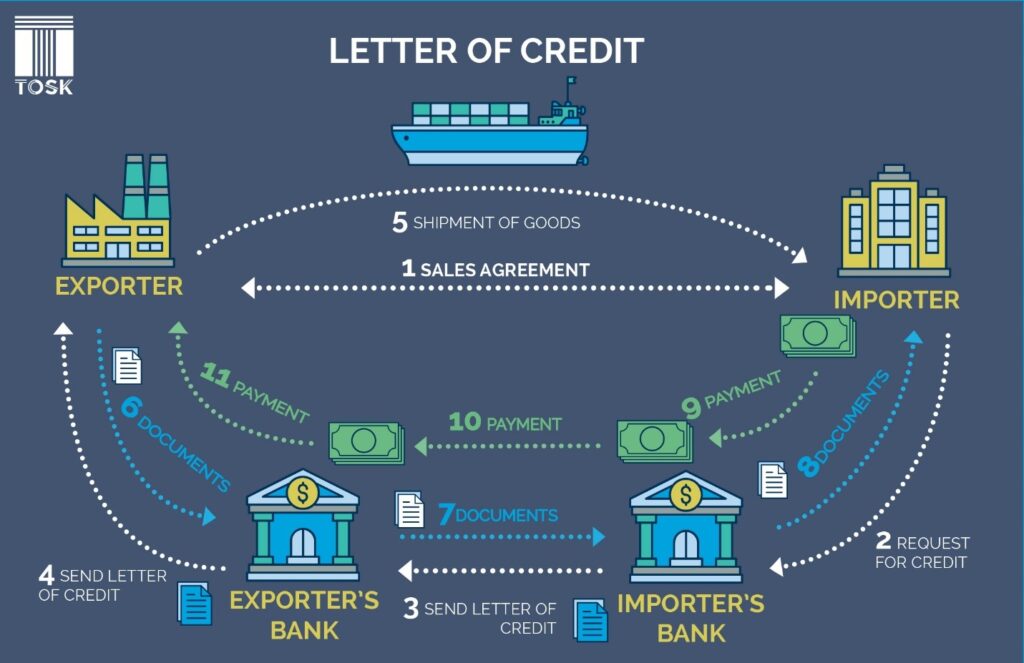

Letters of Credit are issued and formatted under the guidelines of the Uniform Customs & Practice for Documentary Credits, or the UCP-600, that is issued by the International Chamber of Commerce (ICC). Using one is fairly straightforward, both for businesses selling and those buying goods and services.

One of the parties, usually the importer, will contact a bank to serve as an intermediary and to guarantee to the seller that the goods will be paid for according to the agreement. All parties involved need to agree to the terms and sign the contract. This lowers the risk of doing business significantly, as Letters of Credit are legally binding documents that are acknowledged by 175 countries worldwide.

Check the Documents Carefully

Although the guidelines and the form of any Letter of Credit are largely the same, the content is not. It is crucial that both the buyer and the seller inspect the documents carefully and check for errors and mistakes that may end up in delays, further costs, or deferred payment. Even a minor oversight can be quite costly in this regard, and it is advisable to use several sets of eyes to check the documents.

Letter of Credit terms include:

- Advising bank – accepts and then notifies the beneficiary of the LC

- Confirming bank – financial institution that agrees to honour and payment the LC to the beneficiary and receives payment from the advising bank

- Irrevocable – A non-amendable LC, unless agreed by all parties

- Issuing bank / issuer – the party that issues the LC

- Presentation – delivery of the LC documentation and any other required documents that are required by the beneficiary should payment be made / the LC honoured

- Revocable – a type of LC that can be withdrawn, amended or cancelled y the issuing party at any time

- Standby – the most common LC type whereby agreement to pay is made under certain conditions

Who should use a Letter of Credit?

Letters of Credit are useful to any business that trades in large volumes, both domestically, and cross-border. They are important to ensure the cash flow of a company and lowers the risk of default due to non-payment from the end customer.

Additionally, a LC can benefit companies that structure their business around e-Commerce or services.

When deciding whether or not to request a LC, some considerations might include:

- The costs associated versus the risk of non-payment, as well as which party will incur these costs

- Legal requirements and expertise required

- Documentation needed (for proof of delivery, sending the goods across e.g. customs declaration and insurance documents)

- The supplier / customers creditworthiness

Overseas Business

International traders or wholesale producers of goods are the primary users of Letters of Credit. These types of company need to be certain that they will not suffer losses from selling to overseas buyers that they are unfamiliar with. In the unfortunate case that the recipient of the goods is unwilling or unable to pay the seller, the LC is activated, and under the terms of the agreement, the bank will be obliged to cover the missing payment. After the intermediary completes the payment, the bank will deal with the buyer according to the domestic law of the country where the buyer is located.

Online Business

Online, e-commerce and service businesses often use Letters of Credit for overseas contracts. For companies producing software, or other online services that demand the employment of significant resource, it is important to consider external finance to free up working capital.

Small and Medium Enterprises

Small or Medium Enterprises (SMEs) account for 99% of businesses in the UNITED KINGDOM. There were over 5.7 million SMEs active in 2018. Letters of Credit can help alleviate some of the cash flow constraints stemming from delayed and long payment terms from end customers. Large international companies are often culprits for late payments to SMEs, which can often put small companies at financial strain, or even out of business.

What are the Benefits of Using a LC?

Risk and trust are one of the major challenges when it comes to trade, be that domestic or international. The specificity and legal weight of Letters of Credit are a big advantage, given that they are accepted and acknowledged by 175 countries, reduce the risk of doing business overseas, and provide transparent collaboration between unknown parties.

Finally, Letters of Credit provide better clarity on the transaction, as all of the goods or services supplied would be defined in detail. This provides additional comfort to the buyer as well as removing the possibility that the descriptions of the goods ordered are vastly different from what arrives.

Key advantages:

- Avoids potential disputes overseas

- Some form of guarantee to a seller / supplier that they will get paid

- Flexibility and variability across different types of LCs

- Secure payment method endorsed by most major markets

- Risk of non-payment is taken by the banks rather than the buyer

- Often required by national border / exchange control agencies

Alternatives to the Letter of Credit

There are several situations where a business is either unable to get access to a letter of credit, perhaps due to a low credit score, or, because the supplier or customer does not want to use an LC to finance the transaction. Given that open account trade cover 80% of cross-border trade, businesses with good commercial relationships often won’t use LCs. Alternatives to LCs are often used to finance small purchases, perhaps those under $100k, given that they are significantly cheaper and faster to set up.

Revolving Vendor Accounts

In cases where a business has a good trading history, as well as paying its vendors and suppliers in time, revolving vendor accounts can be used to extend payment terms. Using these tools, a business can order supplies, materials, and services in advance on credit. Once all the necessary materials are ordered, a business can forward them to end users or customers, paying the supplier before the credit is due.

This type of account can be problematic however, as the seller may refuse to ship goods and services to a business that hasn’t paid their previous charge. Finally, some sellers will reject to enter this agreement, especially if abroad, as the entire risk of debt collection falls on the seller.

Purchase Order Financing

In this case, a third party, either a commercial bank or another entity can finance the advances or outstanding payables on any goods and services paid, assuming the risk of the sale contract not being fulfilled. This type of financing is usually made for a relatively short time period and it is not as uniform as a Letter of Credit. Due to the fact that all risk is on the third party, this type of credit is usually more expensive and not applicable to sales of common goods. Read our PO finance guide here.

Invoice Factoring

This alternative to LC assumes that a third party, usually a commercial bank, will advance the seller for up to 80% of the total charge, assuming the risk of the customer or buyer paying the invoice in total once the goods arrive. Once the invoice is paid, the bank’s fee is withheld, and the rest of the funds are transferred to the seller’s account. This tool is very useful to companies that suffer from diminished liquidity, but as the bank is taking more risk than when using a Letter of Credit, it is significantly more expensive than an LC. Trade Finance Global have put together a more extensive invoice factoring guide, which can be found here.

Different Types of Letters of Credit

There are different types of LCs depending on the kind of business or transaction that it is needed. In most cases, these secondary features are used to increase security and make the operation easier, faster, and more transparent. While there is a definite time and place of each type of LC, business should be aware that certain additions and clauses stipulated might increase the bank’s fee, or add some features that can cause future problems for one of the parties involved.

- Irrevocable

An Irrevocable Letter of Credit allows the buyer to cancel or amend the LC, provided that other parties agree. This can be used to trade additional goods that were not a part of the original LC inside the same shipment or to allow the exporter of products extra time to fulfil their obligation. - Confirmed

A Confirmed Letter of Credit is used to further ensure the seller by adding more security. This addition stipulates that if the issuing bank from the buyer doesn’t pay the requested amount of money, the seller’s bank guarantees payment. This article can be added if there is reduced trust in the buyer, or if the money requested is crucial to stable financial liquidity of the seller.

Most Letters of Credit will include this clause in the agreement, especially in international trade between partners that haven’t done business in the past.

- Transferable

A Transferable Letter of Credit is commonly used when there are intermediaries involved in the transaction, or when there are more than two parties included in the Letter of Credit. In this case, the LC can be transferred to other entities, provided that the original beneficiary agrees. This type is usually employed by the seller’s bank, especially when the seller is an SME, as a way to reduce the risk of the transaction to the bank, usually decreasing the price of the trade in the process.

- Letter of Credit at Sight

This article of the Letter of Credit stipulates that all payments will be fulfilled as soon as there is documentation that the goods or services have been received by the buyer. This payment can be made by the buyer, or by the buyer’s issuing bank, giving the buyer some additional time to fulfil the debt.

Contrary to this type of LC, there is the Standby Letter of Credit that doesn’t have this clause, and that needs to be activated in the case that the buyer can’t fulfil the payment. - Deferred or Usance Letter of Credit

This type of LC is used to allow deferred payment from the buyer for a specified time period. This slightly reduces the risk of unintentional non-payment and lowers the cost of an LC. Additionally, a Deferred Letter of Credit is more enticing for the buyer, making it more likely for them to accept buying goods or services. - Red Clause

A Red Clause Letter of Credit obligates the buyer’s issuing bank to provide partial payment to the seller prior to shipping products or providing the service. It is usually used to secure a certain supplier and to expedite the shipping process, but it often makes the LC significantly more expensive.

How Can an LC Help Your Business Grow?

Using Letters of Credit can significantly advantage your business, regardless if you are a seller or buyer of goods and services. This trading tool is legally binding in almost all countries of the world, providing better transparency and creating trust in your business. Using an LC, you can do business with any company or business around the world while being certain that all goods agreed upon will be received and that all payments will be fulfilled. For any company, this secured access to the global market means lower prices and better services in a wider market. Additionally, it means that you can safely offer your goods and services to any buyer around the world, with little risk that the products you have provided will not be paid for.

What are the Disadvantages of these Products?

The main disadvantage of using an LC compared to other methods is the relative cost of insurance, that may increase the overall cost of doing business. Letters of Credit should be used primarily on large shipments that may influence the liquidity and cash flow of the company, as well as when doing business with international buyers and sellers.

Additionally, an LC creates an issue for sellers, as the payment will be based on the documentation, and not the actual goods or services provided. Sellers need to be certain that the goods mentioned in the agreement are exactly as they are, with every minute detail included.

Finally, the disadvantage for the buyer is that the payment is connected to the documentation and not the actual provision of goods and services. Buyers need to ensure that all received products are exactly per specifications and have no flaws or damages before they create the necessary documentation that proves that they have received the goods.

We offer:

Documentary credits have worldwide acceptability and can be issued via TELEX or SWIFT. Anyone can arrange a letter of credit with us for a fee. Your credit rating or standing with the bank or lender has no effect. They don’t tie up your cash and we don’t underwrite your company’s financials.

Through our services, you can:

- Increase your trade facility with your suppliers

- Find new suppliers with less of a risk

- Eliminate your risks of tying your cash flow

For existing trade importers, they allow you to work on much larger deals provided they can fit into our structure. They are also the perfect product if you are acting as the middleman to a transaction.

Our Services Include:

- Commercial Letters of Credit

- Confirmed Letter of Credit

- Standby Letter of Credit payment guarantee, payment bond and SBLC. Used for payment obligations from one to another.

- Revolving Letters of Credit

- Back-to-Back Letter of Credit issued by reliance on an incoming letter of credit. Hide the identity of your supplier or manufacturer.

- Bid Bonds (Tender Guarantee) with today’s fast growing market industry, our services as a financial institution can offer securities when business is done across country borders. We can provide tender guarantees to bid on a construction project or a confirmed letter of credit to buy goods or many different types of commercial letters of credit and bank guarantees.

- Performance Guarantee performance bond. A guarantee that clients will fulfil their contract obligations.

- Advance Payment Guarantee advance payment bond issued to a contractual obligation alongside advance payment.